Dandong Insights

Explore the vibrant stories and updates from Dandong and beyond.

The Sneaky Way to Lower Your Auto Insurance Bill

Unlock hidden secrets to slash your auto insurance rates and keep your hard-earned money in your pocket. Discover the sneaky way now!

10 Surprising Discounts You Didn't Know Could Lower Your Auto Insurance Bill

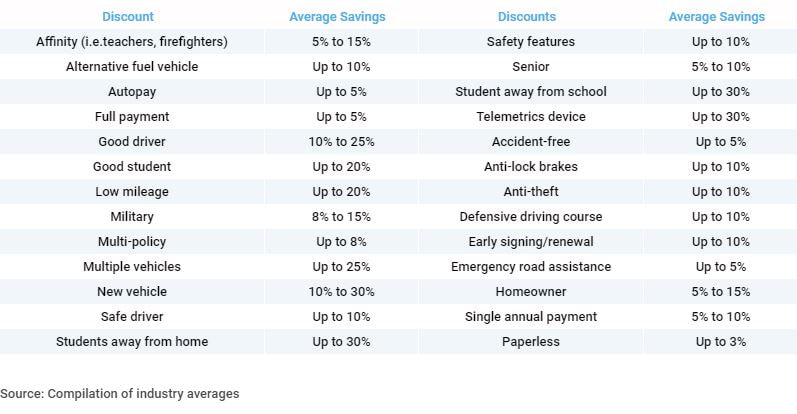

When it comes to saving on your auto insurance, many people overlook some surprising discounts that insurers offer. Here are 10 surprising discounts you didn’t know could lower your auto insurance bill:

- Bundling Discounts: If you have multiple policies with the same provider, such as home and auto insurance, you may qualify for a bundling discount.

- Low Mileage Discounts: Drive less than the average driver? Many insurers offer discounts for low annual mileage, recognizing that fewer miles on the road can reduce your chances of an accident.

- Good Student Discounts: Students who excel academically often receive discounts, acknowledging responsible behavior extends to driving as well.

- Military Discounts: Active duty military personnel and veterans can receive discounts on their auto insurance as a token of appreciation for their service.

- Safety Device Discounts: Installing safety features like anti-lock brakes or alarm systems in your vehicle can qualify you for additional savings.

These are just a few examples, but the list doesn’t stop there. Insurers often offer loyalty discounts for long-term customers and occupational discounts for certain professions, recognizing the reduced risk associated with specific jobs. Always check to see what discounts you may qualify for, as they can greatly affect your premiums and help lower your auto insurance bill.

How Your Credit Score Affects Your Auto Insurance Premium: The Sneaky Connection

Your credit score is not just a number that influences your ability to secure loans; it also plays a significant role in determining your auto insurance premium. Insurers often use credit scores as part of their risk assessment process, believing that individuals with higher credit scores are less likely to file claims. This sneaky connection means that a low credit score could lead to higher insurance rates, making it crucial for drivers to be aware of how their financial behaviors can impact their insurance costs.

To illustrate, consider that many insurance companies weigh credit scores alongside driving history, location, and vehicle make when calculating premiums. A poor credit score might raise your auto insurance premium by hundreds of dollars annually, even if you have a clean driving record. To keep your premiums as low as possible, it's wise to maintain a healthy credit score by paying bills on time, reducing debt, and regularly checking your credit report for errors.

Is Bundling Really Worth It? Exploring the Benefits of Combining Insurance Policies

When considering whether bundling insurance policies is worth it, it's essential to weigh the potential savings against your specific coverage needs. Bundling typically allows consumers to combine multiple types of insurance, such as auto, home, and life insurance, with a single provider. This not only simplifies the management of your policies but often leads to significant cost reductions. For example, many insurance companies offer discounts that can range from 5% to 25% when you opt for a bundled package, making it an attractive option for those looking to save money.

In addition to cost benefits, combining insurance policies can enhance convenience and improve customer service. Having all your policies under one roof means only one point of contact for questions or claims, which can save you time and provide a smoother experience. Furthermore, bundling may allow for more comprehensive coverage options and potentially improve your policy limits. Ultimately, whether bundling is right for you depends on your individual circumstances, but the benefits are certainly worth exploring.