Dandong Insights

Explore the vibrant stories and updates from Dandong and beyond.

Flip the Script: Your Unconventional CS2 Trading Reversal Playbook

Unlock your CS2 trading potential with our unconventional playbook! Flip the script and discover reversal strategies that work.

Mastering the Art of the Reversal: Top Strategies for CS2 Trading

Mastering the Art of the Reversal in CS2 trading requires a keen understanding of market dynamics and trader psychology. One effective strategy is to identify key support and resistance levels. When the price approaches these zones, traders should look for reversal signals such as pin bars or engulfing candles. Timing is crucial; entering a trade too early can lead to losses. Additionally, using technical indicators like the Relative Strength Index (RSI) can help traders spot overbought or oversold conditions, enhancing their decision-making process.

Another powerful strategy for successful CS2 trading is to utilize trend lines and chart patterns. By drawing trend lines, traders can clearly visualize potential reversal points, as well as identify patterns like head and shoulders or double tops. Patience and discipline play vital roles in mastering these techniques; traders should wait for a confirmation of the reversal before entering positions. To wrap things up, keeping a trading journal to reflect on past trades can significantly improve one’s skills in recognizing and exploiting reversal opportunities effectively.

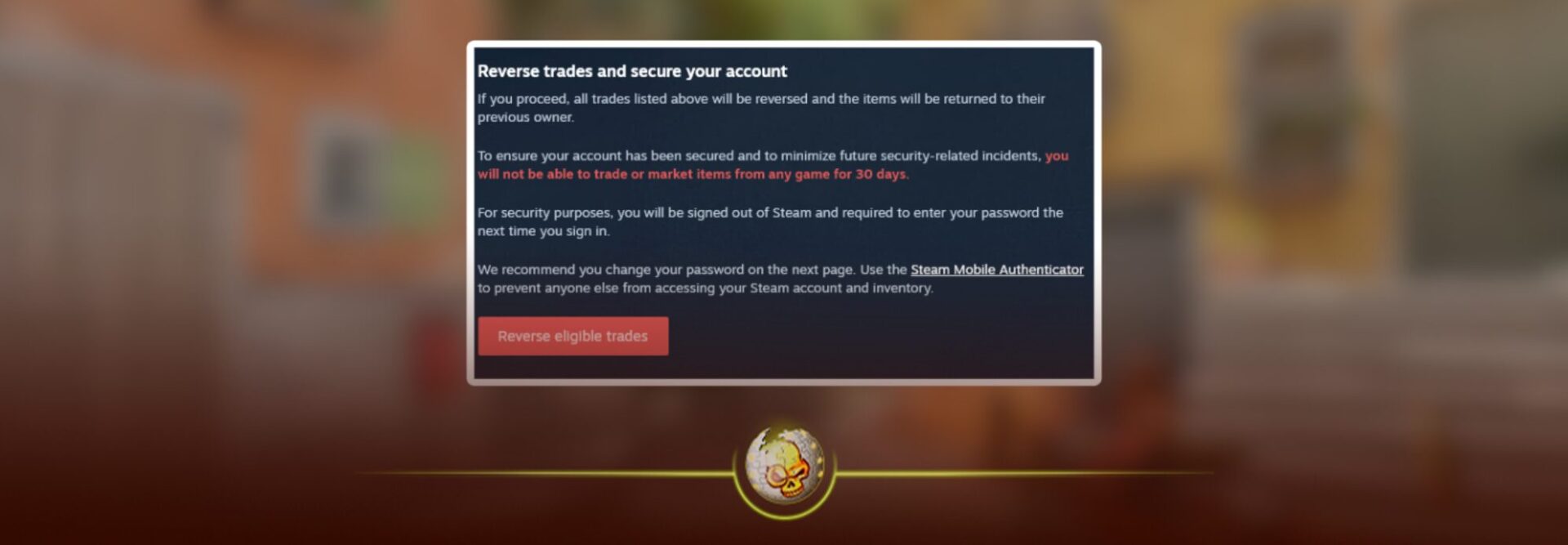

Counter-Strike is a highly popular first-person shooter game that has captivated players since its release. With its strategic gameplay, team coordination, and competitive scene, players engage in intense matches where they either plant bombs or rescue hostages. For those interested in improving their in-game strategies or trading skins, a trade reversal guide can provide valuable insights.

From Loss to Win: How to Flip the Script in CS2 Trades

In the competitive world of CS2 trades, players often face situations where losses can feel overwhelming. However, recognizing these circumstances as opportunities for growth is key. By evaluating past trades, players can flip the script and develop strategies to mitigate losses. Start by analyzing your decision-making process in previous trades. What went wrong? Were your expectations unrealistic? These reflections not only enhance your skills but also build resilience, transforming defeats into valuable learning experiences.

Once you've assessed your past trades, implement the following strategies to turn potential loss into victory:

- Set clear goals: Define what you want to achieve in your trades—whether it's profit objectives or improving your trading technique.

- Diversify your approach: Don't rely on a single trade strategy. Experiment with different methods, keeping in mind the unique dynamics of CS2.

- Stay informed: Keep up-to-date with game changes, market trends, and community insights that can influence your trading decisions.

What Are the Key Indicators for Successful CS2 Trading Reversals?

Understanding the key indicators for successful CS2 trading reversals is crucial for traders aiming to make informed decisions. One of the primary indicators is the use of moving averages. When the price crosses below the moving average, it can signal a potential reversal from an uptrend to a downtrend. Conversely, if the price crosses above the moving average, it may indicate a reversal from a downtrend to an uptrend. Other technical indicators such as the Relative Strength Index (RSI) are also essential as they help determine whether an asset is overbought or oversold, thus unveiling hidden reversal opportunities.

Additionally, traders should pay attention to volume trends. A significant increase in trading volume accompanying price reversals often validates the strength of the reversal. For instance, if a stock experiences a price drop but is met with high volume as it bounces back, this could indicate that a strong reversal is underway. Moreover, observing fundamental news and market sentiment is critical for anticipating CS2 trading reversals. Major announcements or economic indicators can trigger sudden price movements, so staying updated with market news is vital for executing successful trades.