Dandong Insights

Explore the vibrant stories and updates from Dandong and beyond.

Marketplace Liquidity Models: Where Supply Meets Demand in Style

Discover innovative marketplace liquidity models that stylishly balance supply and demand. Unlock insights to boost your business success!

Understanding Marketplace Liquidity Models: Key Concepts and Strategies

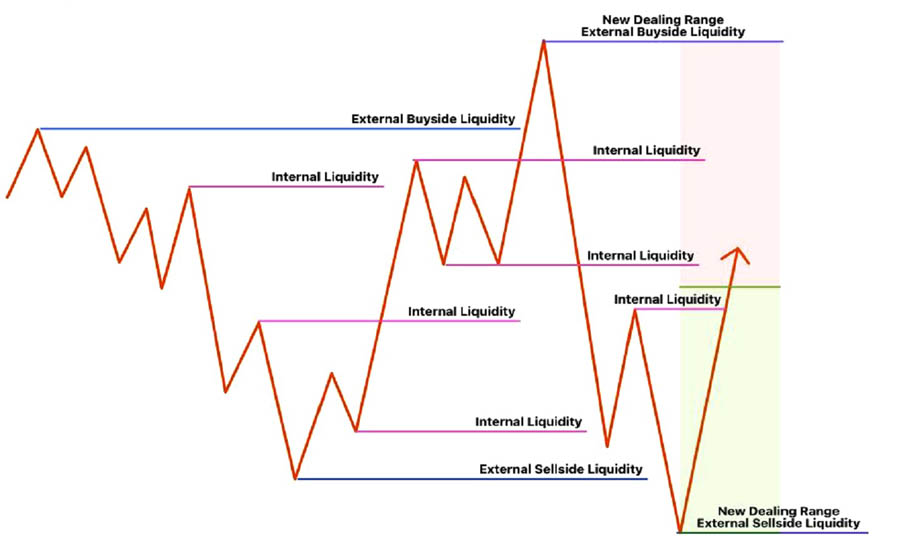

Marketplace liquidity refers to the ability to buy or sell assets without causing significant changes in their price. Understanding the different liquidity models is crucial for participants in any marketplace, as it helps to gauge the ease with which transactions can occur. Key concepts include the definitions of liquidity, the role of market makers, and the impact of transaction volume on price stability. In essence, a market with high liquidity allows for quick trades and less price fluctuation, while a market with low liquidity can lead to greater volatility and difficulties in executing trades.

There are several strategies that participants can employ to optimize their experience in various liquidity models. One effective approach is to utilize limit orders, which can provide more control over the price at which a transaction is executed. Additionally, staying informed about market conditions and utilizing analytical tools can help investors anticipate shifts in liquidity. As markets evolve, embracing adaptability in strategy and understanding the liquidity landscape will ultimately lead to better decision-making and enhanced trading outcomes.

Counter-Strike is a popular tactical first-person shooter video game franchise that has captivated players since its inception. Players can engage in intense multiplayer matches, working as teams of terrorists and counter-terrorists. For those looking to enhance their gaming experience, using a daddyskins promo code can provide valuable in-game items and skins.

How to Enhance Supply and Demand Dynamics in Your Marketplace

Enhancing supply and demand dynamics in your marketplace requires a multifaceted approach that addresses both sides of the equation. Start by conducting thorough market research to identify trends and consumer preferences. Utilize tools like surveys or data analytics to gather insights on what your customers want. This will enable you to align your offerings with market demand effectively. Additionally, ensure that your suppliers operate efficiently to maintain a consistent supply chain, minimizing disruptions that can negatively impact your sales and customer satisfaction.

Another effective strategy is to implement dynamic pricing models that reflect real-time supply and demand conditions. This approach can help maximize profits during high-demand periods while maintaining competitiveness when supply surplus exists. Consider using technologies such as AI and machine learning to better predict shifts in demand and adjust your inventory accordingly. Furthermore, creating promotional campaigns or discounts during low-demand phases can stimulate interest and drive sales, ultimately balancing the supply and demand dynamics within your marketplace.

What Role Do Liquidity Models Play in Marketplace Success?

The success of a marketplace is significantly influenced by the liquidity models it employs. Liquidity refers to how easily assets can be bought or sold in the market without causing drastic price changes. Effective liquidity models ensure a balance between buyers and sellers, thus facilitating rapid transactions. In a thriving marketplace, high liquidity typically leads to lower transaction costs and increased trading volume, which ultimately contributes to a more dynamic and robust economic environment. By attracting a diverse range of participants, liquidity models can help define a marketplace’s reputation and draw in further investment, fostering a cycle of growth and sustainability.

Moreover, the role of liquidity models extends beyond mere transaction facilitation; they also enhance user confidence. When users are assured that they can easily enter and exit positions, they are more likely to engage with the marketplace actively. This psychological reassurance plays a crucial role in market dynamics. For instance, platforms that display reliable liquidity metrics tend to build trust among users, which can lead to increased participation rates. In essence, understanding and optimizing liquidity models becomes paramount for marketplace operators aiming for long-term success and competitive advantage.